Last year, the Jersey Housing Market had its ups and downs. As we look at the second quarter of 2025, we see house prices have gone down roughly 2% from the previous quarter. There was a noticeable 4% fall compared to earlier months and a significant 9% drop from the past year. This trend shows that the cost per square meter of property is falling, impacting both those looking to buy and sell.

Particularly, four-bedroom houses have hit their lowest price point since the third quarter of 2020. Additionally, there’s been a 15% decrease in the number of properties sold compared to the same time in 2023. This drop is much lower than the sales activity before the pandemic hit. The reasons behind these changes include shifts in property sales, the rental market, and recent changes in taxes by the government. This forms a complex picture of the real estate market in Jersey, trying to balance supply and demand amid these changes. For more insights, residents can check out the latest housing report for the details1.

Key Takeaways

- Average house prices in Jersey have decreased by 2% in Q2 2025compared to Q1 2025.

- Four-bedroom houses now exhibit the lowest average price since Q3 2020.

- Annual property turnover has declined by 15% when compared to the same quarter in the previous year.

- Overall housing activity remains below peak pre-pandemic levels.

- Changes in government taxation are impacting the real estate landscape.

Contact us if you are Interested in Buying Property Abroad!

Introduction to Jersey’s Housing Landscape

The housing scene in Jersey is shaped by its unique location and economy. In places like St. Helier, homes cost more because it’s a city area. But, you can find cheaper homes in St. Brelade and Gorey2. New areas such as St. Ouen and Trinity are getting popular among buyers. They offer good prices and a chance for growth2. The Channel Islands market has lots of high-value homes in top spots. This attracts investors looking for safe, long-term options2

Tax benefits are a big plus in Jersey’s housing market. There’s no tax on profits or inheritance, which draws in buyers2. The variety in Jersey’s homes is huge, from charming cottages to fancy villas3. In St. Helier, you find lots of new apartments, old townhouses, and developments3. Meanwhile, St. Brelade is known for its beach homes and luxury places3.

With rising demand for homes and offices, investors must look at the market, laws, and taxes in Jersey2. Jersey’s strong economy offers great living conditions. This is seen in its low jobless rate and good tax system4. People from many countries are buying property here. They are major players in Jersey’s housing market4.

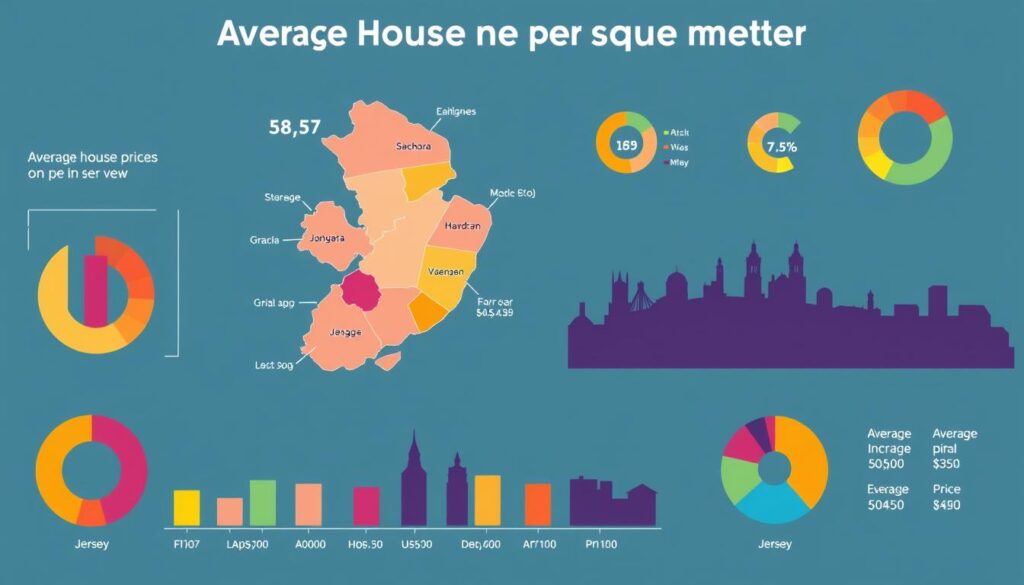

Current Average House Prices in Jersey

The housing market in Jersey is seeing big changes as of early 2025. The average house price is around £574,000. This is way above the UK’s national average.

This high figure suggests a more competitive situation than what’s happening elsewhere.

Comparison of House Prices by Property Type

Different property types in Jersey have varying prices. One-bedroom flats are priced at about £294,000. For two-bedroom places, the cost is £459,000.

Three-bedroom houses are on the top end, with an average of £709,000. These differences show how certain factors impact the overall market value.

Year-over-Year Price Trends

The price trends in Jersey over the past year show interesting patterns. 2023 saw house prices drop by 3% from the previous year5. By the end of 2023, the average price fell to £636,000 from £681,0006.

Four-bedroom houses especially saw a significant price decrease, hitting their lowest since 2020. Things like new builds and the growing affordability issue have played a big role in these shifts56.

| Property Type | Average Price (£) | Year-over-Year Change (%) |

|---|---|---|

| One-Bedroom Flat | 294,000 | -4 |

| Two-Bedroom Flat | 459,000 | 3 |

| Three-Bedroom House | 709,000 | -2 |

| Four-Bedroom House | Lowest since 2020 | -5 |

This overview shows what’s happening with house prices in Jersey now. It underlines how various elements affect property values. For anyone looking to buy or invest, staying informed about these trends is key.

Jersey (Channel Islands) Housing Market Trends

The Jersey housing market has seen big changes lately. There’s been a drop in real estate trends in Channel Islands, with prime values falling -0.4% recently. And, they are now -2.7% lower than last year7. Even with this drop, more buyers are entering the market. This led to an 8% increase in properties sold compared to before. Also, sales for homes over £1 million jumped by 11% this year in Q2. Listings for these expensive homes rose by 13% from last year7.

A recent study shows that 92% of regional agents see more homes for sale7. In villages and countryside areas, home values went down -2.9% and -3.2% respectively. However, the number of homes in Jersey grew by 9% in the last ten years. By 2021, there were 48,610 homes, and 54% of them had owners living in them8. But still, about 8% of houses are empty, often due to being fixed up or built.

Changes in taxes for new homeowners could change how people buy homes, affecting Jersey housing market trends in the future. Challenges like environmental rules and planning issues make it tough to build new homes. Yet, prices may start to stabilize by 2025. Still, how affordable these homes will be depends a lot on the economy8.

Contact us if you are Interested in Buying Property Abroad!

Impact of Rental Market on Property Prices

The rental market in Jersey is key in setting property prices, shaped by the data in the Jersey Private Sector Rental Index. This index shows a 4% drop in rental prices year-on-year. It reflects how hard it is for tenants to find affordable homes due to changing demand.

Private Sector Rental Index Overview

The Jersey Private Sector Rental Index sheds light on rent trends on the island. The rental market changes due to economic pressures, affecting property prices. Recently, rental prices have closely followed the ups and downs of the housing market and tenant’s budget stresses. This makes more renters look for cheaper housing options.

Rental Market Trends and Average Prices

Rental market shifts affect both current and future property investors. Rental prices show a decrease, making housing costs a bigger part of people’s income. Figures highlight changes, especially in one-bedroom properties, impacting the housing market in Jersey9.Recent rental conditions reinforce these findings, showing renters’ financial struggles.

| Rental Market Insights | 2021 | 2022 | 2023 |

|---|---|---|---|

| Rental Growth (%) | 11.2 | 9.5 | Forecasted 9.5 |

| Average Income Spent on Rent (%) | 33 | 35.3 | N/A |

| Reduction in Homes Listed Compared to Pre-Pandemic (%) | N/A | N/A | 28 |

As the rental market changes, keeping property prices stable becomes harder due to high demand and less supply. The link between rental trends and property values is key for those looking to buy or invest in Jersey’s housing market1011.

Factors Influencing Jersey’s Housing Market

The Jersey housing market is changing due to many issues. For starters, the first-time buyer stamp duty now goes up to £700,000. This helps new buyers afford their first homes. Because of this change, how people buy homes in Jersey is shifting.

New property projects in Jersey aim to meet the need for affordable homes. Over 3,000 people need help finding housing. These projects aim to make homes more accessible, helping with the housing crunch.

These factors make Jersey’s housing market complex. For more depth, check out Jersey’s Fiscal Policy Panel Housing Market. It offers in-depth insights into the market’s challenges121314.

Sectorial Analysis of Jersey’s Property Market

Jersey’s property market is quite unique, especially when comparing flats and houses. Flats are usually more affordable, which is great for first-time buyers. On the other hand, houses are more expensive. This shows how different buyers find what they need in the market.

Comparative Analysis of Flats and Houses

In recent years, both flats and houses in Jersey have become more in demand. Even though prices are going up overall, a deeper look shows property prices growing, especially for more expensive homes. For example, homes priced between £500,000 to £1 million saw a 31% increase. Homes costing between £1 million and £2 million saw a 47% jump15.

This rise in prices shows that buying a home is still tough for many, with demand staying ahead of supply15. The average price for a house reaching £491,000 in 2018 shows that high-end homes are very much wanted. This makes the market competitive15.

Trends in Ultra-Prime Properties

Ultra-prime properties in Jersey are a special part of the market. These properties are not sold often but keep their value well thanks to their unique features and great locations. Jersey’s appealing lifestyle and low taxes attract wealthy people, helping keep prices stable in these top-tier areas16.

Recently, there’s been a slight increase in demand for bigger homes. This shows there could be new growth areas in the market. With population growth expected, Jersey might face a shortage of about 2,750 homes in three years15. This need will shape the future of Jersey’s real estate, showing how the economy is always changing.

| Property Type | Average Price | Price Increase Since 2018 |

|---|---|---|

| Flats | £350,000 | 15% |

| Houses | £600,000 | 20% |

| Ultra-Prime Properties | £1,500,000 | 30% |

The table shows the average prices and trends in Jersey’s property market. The growing demand and changing buyer preferences mean there are exciting chances for both investors and those looking to buy a home.

Conclusion

The Jersey property market is complicated. It shows how prices, laws, and what buyers want change together. High home prices in Jersey make it hard for young locals to find a place to live. This shows why we need more affordable homes to make things fair for everyone.

From 2000 to 2008, the market grew strong. Then, it slowed down because of financial troubles. After 2010, things started to get better, showing the market can overcome challenges. But, rising living costs and high interest rates recently made buying a home in Jersey harder.

The future of Jersey’s housing market depends on helping those in urgent need of better homes. It also relies on handling the higher cost of living. Talks about supporting homeowners and making housing more affordable are key. They will help keep Jersey a great place for property investment171819.

Contact us if you are Interested in Buying Property Abroad!

FAQ

What are the current average house prices in Jersey?

As of early 2025, the average house price in Jersey is about £574,000. One-bedroom flats are priced at £294,000 on average. For three-bedroom houses, the average is £709,000.

How is the rental market impacting property prices in Jersey?

In Jersey, rental market trends are reshaping house prices. With a 4% drop in rents noted by the Private Sector Rental Index, the path to housing affordability is a hot topic.

What factors are currently influencing the Jersey housing market?

The Jersey housing scene is shaped by various elements. This includes new rules for first-time buyers’ stamp duty, affordable housing projects, and tax policy changes.

What recent trends have emerged in the Jersey property market?

The Jersey property scene shows a 15% drop in property sales compared to 2023. Plus, a downturn in prices for many property types suggests a shaking housing sector.

How do house prices in Jersey compare to the UK national average?

Compared to the UK, Jersey’s house prices start much higher. Especially for large homes, Jersey’s market shows its unique position with significantly higher averages.

What changes were made to the first-time buyer stamp duty in 2025?

To help new homebuyers, the 2025 update lifted the stamp duty threshold from £500,000 to £700,000.

How are ultra-prime properties performing in the Jersey real estate market?

In Jersey, top-tier properties keep their high value thanks to unique features and preferred locations. They often fetch prices above the norm, showing the market’s strength.

Are there any upcoming initiatives aimed at affordable housing in Jersey?

Yes, Jersey is working on new housing projects to make homes more affordable. However, with many people needing housing help, it’s a real challenge.

Source Links

- https://jerseyeveningpost.com/uncategorised/2021/05/21/average-house-prices-rise-to-record-levels/

- https://www.propertyskipper.com/jersey/things-to-do-in-jersey/2024_guide_to_investment_property_in_jersey_channel_islands

- https://investinginproperties.co.uk/discovering-property-for-sale-in-the-jersey-channel-islands/

- https://www.fineandcountry.co.uk/insights/blog/buying-property-in-jersey-everything-you-should-know

- https://www.collascrill.com/articles/2023-review-of-the-jersey-property-market/

- https://jerseyeveningpost.com/news/2024/02/16/housing-affordability-in-jersey-will-come-back-again/

- https://www.savills.je/research_articles/262231/363997-0

- https://www.policy.je/papers/housing

- https://www.policy.je/papers/housing-and-social-mobility-in-jersey

- https://www.savills.je/research_articles/262231/358740-0

- https://www.savills.je/research_articles/262231/353669-0

- https://www.boleat.com/materials/housing_jersey.pdf

- https://www.bbc.co.uk/news/world-europe-jersey-68577049

- https://consumercouncil.je/news/a-letter-to-mortgage-providers

- https://www.savills.com/research_articles/255800/281974-0

- https://benestsyvret.com/the-2023-end-of-term-report-for-the-jersey-property-market/

- https://www.jerseyeveningpost.com/voices/2023/08/25/jerseys-approach-it-doesnt-matter-what-the-cost-of-property-is-if-you-cant-pay-well-help/

- https://jerseyeveningpost.com/news/2024/04/17/property-costs-causing-problems-with-staffing/

- https://money.je/jersey-housing-market-as-a-monument-to-greed/

Comments