The Thailand housing market has become an area of significant interest for both local and international buyers. With an average house price of approximately ฿145,000 ($4,000) per square meter, many factors influence the diversity in pricing across the country. Depending on the location, size, age of the property, and proximity to key transportation hubs like the BTS or MRT stations, the prices can vary considerably. For example, smaller houses ranging from 100 to 200 sqm typically cost between ฿3 million to ฿5 million ($84,000 to $140,000), while larger family homes of 300 to 500 sqm range from ฿10 million to ฿20 million ($280,000 to $560,000). Luxury properties, particularly beachfront villas and high-end estates, can surpass ฿50 million ($1.4 million).

Key Takeaways

- The average house price in Thailand is about ฿145,000 ($4,000) per square meter.

- Thailand home prices can vary significantly based on location, property size, and age.

- Smaller homes cost between ฿3 million to ฿5 million ($84,000 to $140,000).

- Larger family homes range from ฿10 million to ฿20 million ($280,000 to $560,000).

- Luxury beachfront properties can exceed ฿50 million ($1.4 million).

Contact us if you are Interested in Buying Property Abroad!

Introduction to the Thailand Housing Market

The Thailand housing market is increasingly gaining attention due to its robust growth and appealing investment opportunities. The country’s economic indicators forecasted for 2024 exhibit positive trends, with a projected GDP growth rate of 4.4% and an estimated employment rate of 67.36%. These factors significantly contribute to a vibrant Thailand real estate landscape.

Additionally, the market size is expected to grow from USD 154.51 Billion in 2024 to USD 202.33 Billion in 2029, supported by a Compound Annual Growth Rate (CAGR) of 5.54%. Key players in the market, including Sansiri Public Co. Ltd, Property Perfect, and Pruksa Holding, are playing crucial roles in this growth trajectory.

Why Thailand is Attractive for Real Estate Investment

One of the primary reasons why Thailand real estate investment is attractive is the country’s stable economic environment, highlighted by a Fragile State Index score of 70. This stable environment, coupled with an inflation rate ranging between -0.3% and 1.7% for 2024, creates an appealing atmosphere for property investment Thailand.

Factors Influencing House Prices

Several factors influence house prices in Thailand, including:

- Location: Proximity to urban centers like Bangkok and tourist hotspots like Phuket significantly impacts property values.

- Land Size and Age of Construction: Larger plots and newer constructions generally command higher prices.

- Amenities: Properties close to amenities such as schools, hospitals, and shopping centers tend to be more expensive.

Furthermore, rental yields in Thailand housing market have shown slight fluctuations, with Q4 2023 yields at 5.79%. The expected appreciation of property values and high demand for expat housing Thailand adds long-term investment value.

Overview of Popular Cities

Popular cities in Thailand, such as Bangkok, Phuket, and Chiang Mai, each offer unique real estate opportunities:

| City | Key Features | Investment Potential |

|---|---|---|

| Bangkok | Luxury properties in areas like Silom and Sukhumvit | High, with rising real estate values |

| Phuket | Upscale neighborhoods in Southeast Phuket | Robust, driven by tourism |

| Chiang Mai | More affordable housing options in the North | Moderate, with consistent growth |

In summary, Thailand presents a dynamic and diverse real estate market. From luxury urban condos to affordable suburban homes, the country remains an attractive option for expat housing Thailand and property investors alike.

House Prices in Bangkok

Bangkok’s real estate market is known for its dynamic nature, particularly in central and luxury districts. The rise in urban development, growing demand, and infrastructure investments significantly impact property prices. Luxury properties and prime locations have experienced notable price increases due to modern amenities and proximity to business districts.

Condos in Bangkok

Condos in Bangkok showcase a wide range of pricing. On average, condos cost around ฿7 million, approximately ฿135,000 per square meter. However, in prestigious developments like Scope Langsuan and Marque, prices can exceed ฿500,000 per square meter. Suburban condos, by contrast, can be priced below ฿50,000 per square meter, demonstrating the importance of location in property valuation.

Bangkok real estate provides a diverse spectrum for investors and homebuyers alike. As observed, the housing market trends show a considerable focus on urban growth and foreign investment, leading to significant appreciation in property values.

Houses in Bangkok

Houses in Bangkok, on average, are priced at around ฿15 million or ฿58,000 per square meter. Despite a broad price spectrum, the lowest house prices start at approximately USD $175,000. Luxury districts such as Silom, Sukhumvit, and Ratchathewi are among the top echelons of Bangkok’s housing market.

Luxury Properties in Bangkok

Thailand luxury homes, especially in central Bangkok, witness the highest growth due to modern amenities and strategic locations. The price surge in coveted districts continues to attract both local and international buyers. Factors such as ongoing infrastructure projects, including new mass transit lines, further bolster the rise in property values.

The city’s infrastructure enhancements and the demographic shift towards urban migration and an increasing expatriate community drive the demand for Bangkok real estate. As Bangkok’s property market displays resilience and continuous growth, prospects for investment remain promising for those seeking Thai condominiums or other luxury residential options.

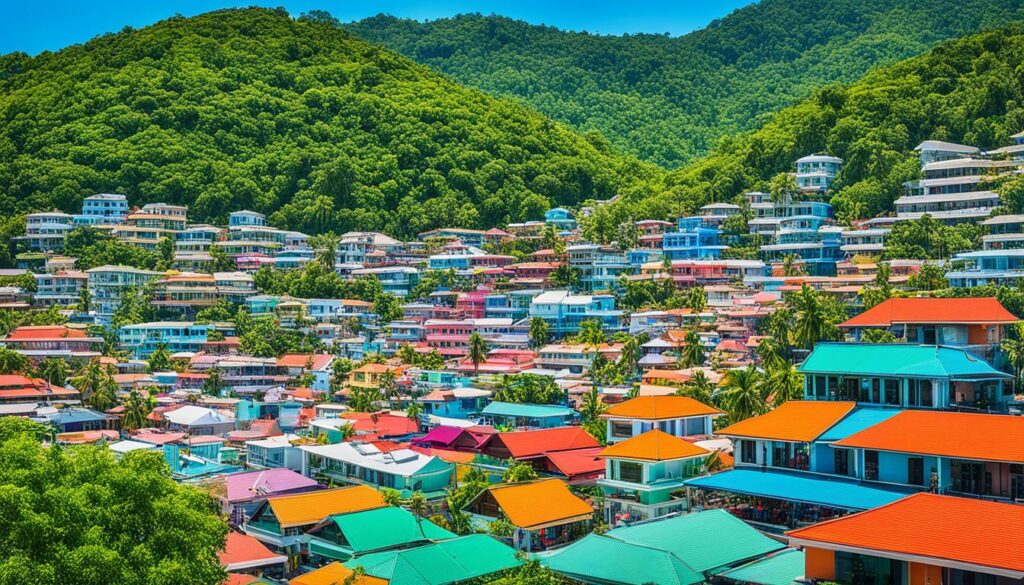

Housing Prices in Phuket

Phuket, a renowned island destination in Thailand, has a diverse housing market catering to both high-end investors and those seeking more affordable options. The Phuket property market benefits from a robust Thailand rental market, making it a highly attractive location for real estate investments. Let’s explore the various housing options available in this tropical paradise.

Beachfront Villas and Holiday Homes

Beachfront villas and holiday homes in Phuket are highly sought after, drawing interest from affluent foreign buyers. Properties in areas like Kamala Beach, Laguna, and Karon are among the most expensive, with luxury villas near Kamala Beach costing approximately $760,000. The average price per square meter for high-end properties is around $3,140, presenting a lucrative opportunity for those looking to invest in Phuket property.

Contact us if you are Interested in Buying Property Abroad!

Affordable Suburban Homes

For those seeking more budget-friendly options, Phuket offers affordable suburban homes in less-developed regions such as the northern and eastern parts of the island. A one-bedroom condo in Patong, for instance, might be priced at around $160,000, while suburban homes offer more competitive prices, making it feasible for a broader range of buyers.

Expected Growth Trends

According to property consultant CBRE Thailand, the Phuket residential market is expected to see a robust increase in housing prices in 2024, with a projected growth of 10-15%. The Phuket property price-to-rent ratio stands at around 24.7, making the Thailand rental market an enticing prospect for long-term investments. Additionally, the market saw significant sales of resort villas and condos driven by foreign travelers with high purchasing power.

Although there was a slight year-to-year decrease in growth, the housing prices on Phuket are still 30% cheaper than in Koh Samui, indicating considerable investment potential.

| Location | Average Price (per sq. meter) | Property Type | Price Estimate |

|---|---|---|---|

| Kamala Beach | $3,140 | Villa | $760,000 |

| Patong | $3,140 | Condo | $160,000 |

| North/East Suburbs | $3,140 | 1-Bedroom | $188,000 |

House Prices in Chiang Mai

Chiang Mai offers an appealing blend of culture, affordability, and tranquility, making it a top choice for digital nomads, retirees, and investors alike. Chiang Mai real estate presents a variety of options for potential buyers, and the cost-effectiveness of acquiring property here cannot be overstated. The average house price per square meter ranges from USD $287,734 to USD $1,113,075, reflecting the city’s capacity to appeal to diverse budgets.

The variance in house prices highlights the diversity in options available. For instance, the lowest-priced house, located in Hang Dong, is listed at USD $287,734, whereas some prime properties in Mae Rim can reach as high as USD $1,113,075. This vast difference of USD $825,341 between the lowest and highest priced houses allows for affordable Thai housing within reach for many.

Comparative analysis shows that areas like Hang Dong present more affordable options compared to higher-priced neighborhoods such as Mae Rim and Saraphi. The cost of living generally escalates the closer one gets to the city center, with suburbs like Nimmanhaemin and Chang Phueak offering more luxurious residential options. Despite this, Chiang Mai housing prices are approximately 68% cheaper than in Bangkok, making it a highly attractive option for those looking at affordable Thai housing.

Condos in Chiang Mai typically average around ฿3 million or ฿60,000 per square meter, while houses can cost around ฿5 million or ฿25,000 per square meter. The affordability of Chiang Mai real estate continues to be a major draw for investors, especially given the city’s rich cultural heritage and relaxed lifestyle.

Additionally, the property price per square meter in Chiang Mai averages $1,820, presenting a more cost-effective option compared to major global cities like Paris or London. Moreover, the property price-to-rent ratio stands at about 22.13, indicating an average of 22 years of rental payments required to purchase a property here, aligning well with the global average.

With Thailand’s economy projected to grow by 15.1% in the next five years, driven by an average GDP growth rate of 3%, the demand for Chiang Mai real estate is poised to rise. The city’s affordability, coupled with its potential for appreciation, underscores why it remains a favorable destination for both domestic and international property investors.

Read more about the evolving real estate landscape in Chiang Mai.

Key Factors Affecting Property Prices in Thailand

Understanding various parameters influencing property prices is essential for navigating the Thailand Housing Market. Several key factors have a significant impact, ranging from location to the quality of construction and proximity to amenities. These aspects dictate the value and appeal of any property within the Thai housing trends.

Location

Location is one of the most pivotal elements affecting property values in Thailand. Areas with central and prime locations, such as downtown Bangkok or beachfront properties in Phuket, naturally attract higher prices. Here, demand tends to be robust, fueled by the appeal of living in proximity to business hubs, shopping districts, and leisure facilities. The Thailand Housing Market has seen a substantial increase in condo demand, with over 3,000 units in Bangkok’s suburbs alone during the first quarter of 2023, indicating a significant shift towards suburban living.

Construction Quality and Age

The age and construction quality of a property are crucial considerations in the Thai housing trends. Newer buildings, as expected, typically command higher prices due to modern designs and enhanced durability. For instance, luxury properties with sustainable designs, such as Zero Energy homes featuring solar cells, are indicative of high-quality construction. Aging buildings, unless subject to renovation or located in highly desirable areas, tend to be priced lower. In Bangkok’s Central Business Area, the non-serviced apartment stock was approximately 10,900 units in 2Q23, with a significant portion built before 1997, reflecting varying price points based on construction age.

Proximity to Amenities

Being near essential amenities significantly boosts property desirability. Homes located close to supermarkets, schools, and public transportation are often priced at a premium due to the convenience they offer. The surge in demand for experiential retail spaces, driven by the growth of e-commerce, further underscores the importance of location in property valuation. Moreover, developers are increasingly incorporating features like EV chargers to cater to the expanding electric vehicle user base, aligning with sustainability trends. Access to these modern amenities and facilities is a strong selling point in the Thailand Housing Market.

In addition to these primary factors, other elements such as demographic shifts, urbanization, and evolving government policies also play a role in shaping the housing market. As per the latest trends, the sector is increasingly focusing on sustainable development, reflecting the broader trajectory of the real estate landscape in Thailand.

Conclusion

The housing market in Thailand is a dynamic landscape, making it an enticing prospect for property investment Thailand. With the focus on the upper mid-level market, properties are typically priced between THB 15-30 million. This range underscores the market’s emphasis on larger residential units that cater to both domestic end-users and foreign buyers looking for second homes.

Locations like Bangkok, Phuket, and Chiang Mai showcase a variety of options, from luxury villas to practical townhouses. The demand for residential and commercial properties in Bangkok is particularly driven by the city’s rapid expansion and development. Emerging areas such as Bangna, Rama IX, and Ratchada are increasingly popular, attracting significant investment.

The market has also seen a rebound in the tourism sector, spurring higher demand for hospitality properties. Additionally, Thailand’s rental market is experiencing growth due to a transient expat population. For commercial investments, the rise in demand for office and retail spaces within mixed-use developments cannot be overlooked. Investors should consider factors like location and property type when buying real estate in Thailand.

In conclusion, Thailand’s real estate market holds promising prospects backed by a recovering economy, government infrastructure investments, and favorable foreign ownership laws. Developers are also modernizing properties with smart home technologies and leveraging digital marketing strategies, making it an optimal time for property investment in Thailand.

Contact us if you are Interested in Buying Property Abroad!

FAQ

What is the average house price per square meter in Thailand?

What makes Thailand attractive for real estate investment?

What factors influence house prices in Thailand?

How much do condos in Bangkok cost?

What is the price range for houses in Bangkok?

How are luxury properties priced in Bangkok?

What are the housing prices like in Phuket?

Are there affordable housing options in Phuket?

What are the expected growth trends for Phuket's real estate market?

How much do houses cost in Chiang Mai?

What contributes to the affordability of Chiang Mai real estate?

Why is location important when considering property prices in Thailand?

How does the construction quality and age of a building affect its price?

Why is proximity to amenities significant in determining property prices?

Source Links

- https://ownpropertyabroad.com/thailand/house-prices-in-thailand/

- https://www.conradproperties.asia/blog-news/koh-samui-property-market-trends

- https://www.investasian.com/property-investment/thailand-house-prices/

- https://silkestate.io/thailand-property-market-2024/

- https://www.mordorintelligence.com/industry-reports/residential-real-estate-market-in-thailand

- https://silkestate.io/thailand-property-market-outlook-2022/

- https://www.realtor.com/international/th//

- https://bambooroutes.com/blogs/news/bangkok-real-estate-market

- https://www.bangkokpost.com/property/2743516/residential-property-market-remains-tepid-this-year

- https://bambooroutes.com/blogs/news/phuket-property

- https://www.linkedin.com/pulse/dynamic-real-estate-market-phuket-propertyscout-9l1nc

- https://www.realtor.com/international/th/chiang-mai//

- https://bambooroutes.com/blogs/news/chiang-mai-property

- https://propertyscout.co.th/en/guides/thai-property-market-2023-2024/

- https://www.thailand-business-news.com/real-estate/109444-rising-interest-rates-impacting-bangkoks-residential-market

- https://www.linkedin.com/pulse/navigating-dynamics-thai-property-market-2024-propertyscout-y4lpc

- https://www.realestaterama.com/developers-adapt-to-changing-trends-in-thailands-2024-real-estate-market-ID056700.html

- https://www.thailand-realestate.com/thailand-property/thailand-property-market-trends

Living in Thailand: A Complete Guide:

- Average Rent in Thailand: Insights & Figures

- Average Salary in Thailand Insights 2024

- Top Best Places to Live in Thailand Revealed

- Understanding Cost of Living in Thailand

- Secure Your Home with Insurance in Thailand

- Your Guide on How to Move to Thailand Effortlessly

- Opening a Bank Account in Thailand: Easy Steps

- Understanding Renting in Thailand Rules – Your Guide

- Top School in Thailand for Quality Education

- Studying in Thailand: A Guide for International Students

- Navigating Taxes in Thailand: A Simple Guide

- Thailand Citizenship: Your Ultimate Guide

- Thailand Company Formation: Quick & Easy Guide

- Unlock Thailand: Your Golden Visa Guide

- Your Guide to a Thailand Residence Permit

Comments