When considering international property investment, Taiwan offers an intriguing opportunity. Many wonder if buying property as a non-Taiwanese resident is feasible. The answer is a resounding yes, with some caveats: Foreigners, excluding nationals and companies from the People’s Republic of China, can own real estate and shares in property-owning companies in Taiwan, subject to government approvals based on reciprocal agreements1. This regulation facilitates foreign investment in the thriving real estate market in Taiwan.

Ownership of property in Taiwan is formalized via registration with the land office, ensuring that the transaction is legally valid and recognized. Additionally, any changes in property ownership must also be registered to maintain the accuracy of the records1. This structured approach ensures that the real estate market in Taiwan remains transparent and reliable for international buyers.

It is important to note that while Taiwan has a public search system for property owners, the full names of individual owners are partially redacted to protect privacy under the Personal Data Protection Act1. This enables property buyers to verify ownership details while maintaining a level of confidentiality.

Key Takeaways: How to Buy a Property in Taiwan

- Foreigners can indeed buy real estate in Taiwan, with some governmental approvals required.

- Property ownership must be registered with the land office to ensure legality.

- Privacy laws ensure the names of individual property owners are partially redacted in public searches.

- Reciprocal agreements play a crucial role in property eligibility for foreign investors.

- Registration updates are mandatory for any changes in property ownership.

In conclusion, Taiwan’s real estate market is accessible to international buyers who meet specific criteria, making it a viable option for those looking to invest abroad. Whether you’re interested in residential or commercial properties, understanding the local regulations and processes is critical for a successful purchase.

Contact us if you are Interested in Buying Property Abroad!

Overview of Foreign Ownership Regulations in Taiwan

The foreign ownership regulations in Taiwan are structured to provide opportunities while setting specific boundaries to safeguard national interests. Taiwan allows foreign real estate ownership subject to certain conditions and government approvals, typically granted on a reciprocal basis. This means that foreign nationals can own property in Taiwan, provided their home country offers similar rights to Taiwanese citizens1. Reciprocity agreements are thus fundamental for eligibility in purchasing property.

Legal Framework

Understanding the legal framework of foreign ownership regulations in Taiwan is critical for investors. The regulatory environment governs sectors with distinct restrictions on foreign investment, such as telecommunications, cable TV, and real estate development2. The Taiwan real estate investment laws require foreign entities to engage in local property registration for their transactions and property ownership to be legally recognized1. Foreigners may reside in their properties without needing special approval after proper registration is complete1. This legal structure ensures transparency and adherence to the established guidelines, reducing potential legal issues for foreign buyers.

Reciprocal Agreements

Reciprocal agreements significantly influence foreign ownership regulations in Taiwan. These agreements are essential as they maintain a balanced investment relationship between Taiwan and other nations. Nations offering favorable terms to Taiwanese investors can expect similar treatment for their nationals in Taiwan. This reciprocity principle is integral in real estate dealings, emphasizing the mutual benefit for cross-border property investments1. Regarding government procedures, changes in ownership and property transactions are supported by clear guidelines through the property registration in Taiwan system, helping achieve secure transactions and legal clarity1. This balance of openness and regulation supports Taiwan’s effort to attract foreign investments while preserving national interests through a robust legal framework21.

For those looking to invest, Taiwan offers notable incentives and retains transparency in its investment climate. The country’s efforts to attract foreign investments and initiatives such as the reshoring of Taiwan firms, combined with its transparent property registration in Taiwan, underscore its appeal to international investors reshoring program in 20192. This balance between opportunity and regulation establishes Taiwan as a favorable destination for foreign real estate investments. Significant international engagements highlight Taiwan’s economic standing, as seen with the U.S. being the ninth largest trading partner2.

How Foreigners Can Buy Property in Taiwan

When considering the Taiwan real estate acquisition process, foreigners should begin by verifying if their home country has a reciprocal agreement with Taiwan. This is a critical first step in ensuring eligibility for property purchase. Foreign individuals, as well as foreign corporations, are generally eligible to purchase property in Taiwan, provided these agreements are in place3.

Engaging in the purchasing process for foreigners involves several key stages. Initially, prospective buyers must select a property that matches their requirements and budget. It’s essential to understand that property prices vary significantly across different cities. For example, Taipei City, known for its urban living and career opportunities, has average property prices ranging from TWD 500,000 to TWD 1,000,000 per square meter, depending on the district3. In contrast, Taichung offers more affordable options, with prices ranging from TWD 200,000 to TWD 600,000 per square meter3.

Having selected a property, the next step involves making a detailed financial plan. Foreign investment is vigorously flowing into Taiwan’s property market, reflecting the robust interest among expatriates3. However, it’s crucial to consider factors such as high property prices and the yield of the investment. Real estate prices in Taiwan are perceived as significantly overvalued compared to the average local salary, presenting a challenging scenario for both locals and expatriates4. Furthermore, rental yields in Taipei are notably low, around 1.5%, making these investments less attractive when juxtaposed against inflation rates4.

A comprehensive property market guide for expatriates would recommend engaging a series of professionals for due diligence. These include legal, financial, and technical advisors, alongside employing a scrivener for tax and title transfer duties. While foreigners can purchase land or houses with relatively few restrictions, it’s pivotal to remember that property ownership does not automatically grant residency rights4. Advisable due diligence involves understanding Taiwan’s local laws to navigate potential risks, such as demographic challenges and limited growth potential due to an aging population4.

To gain more insight from real experiences, consider exploring this personal journey of buying a house in Taiwan, detailing the nuances and potential challenges of such an endeavor.

Visa and Residency Requirements for Buying Property

Navigating Taiwan visa policies is a crucial step for those considering property investment in Taiwan. While specific visa or residency statuses for property purchase are not explicitly mandated, they play a significant role, especially for securing financial options such as mortgages. Taiwan, known as the 8th largest economy in Asia and the 21st largest economy in the world by purchasing power parity, offers attractive opportunities for foreign investors5.

Generally, non-Taiwanese property ownership does not automatically result in residency rights. Potential buyers need to consult local authorities or legal advisors to understand how owning property might impact their visa or residency status. This becomes particularly relevant when discussing expat residency for property purchase.

For foreigners, owning property in Taiwan often requires an Alien Resident Certificate (ARC) or a Taiwan Resident Certificate (TARC). Some financial institutions in Taiwan may even demand a local guarantor with a Taiwan ID (身分證) for mortgage approval6.

Ultimately, understanding these legal and logistic intricacies surrounding Taiwan visa policies and expat residency for property purchase ensures a smoother path for non-Taiwanese property ownership. It is crucial to be well-prepared financially and legally to navigate the complexities of property purchase in Taiwan.

Types of Real Estate Foreigners Can Purchase

When considering real estate investments in Taiwan, foreigners have a variety of options available. Whether you are interested in residential real estate for expats or looking into commercial property investment opportunities, Taiwan’s real estate market accommodates diverse investment needs.

Residential Properties

Foreign nationals can buy apartments in Taiwan with relatively minimal restrictions, making residential real estate for expats a viable option7. This encompasses a wide range of properties including apartments, houses, and multi-family residences. Taipei, being the capital city, presents high real estate values approximately $7,000 per square meter4. Despite the premium price, a modest 100 sqm two-bedroom house in Taipei sells for about $700,0004. Notably, rental yields in Taiwan, particularly in Taipei, hover around 2%, which is below the inflation rate and considered among the lowest in Asia4.

Commercial Properties

Commercial property investment in Taiwan is equally accessible and appealing. Foreigners are allowed to acquire various types of commercial real estate, such as office buildings and retail spaces8. Capital appreciation in commercial sectors might offer more favorable returns compared to residential investments, based on market demands and structural factors. However, it is crucial to note that buying high-value residential or commercial properties in major cities like Taipei might be subject to specific loan-to-value ratios, which need to be considered during the purchase process8. Property in Taipei, while expensive, can be a lucrative commercial property investment avenue for those aiming to establish a foothold in Taiwan’s real estate market.

Laws in Taiwan allow for a straightforward procedure for buying apartments in Taiwan, with compulsory real estate registration ensuring transparency and security for foreign buyers8. This ease of process, combined with the prospect of owning commercial properties, makes Taiwan a compelling destination for diverse real estate investments.

Contact us if you are Interested in Buying Property Abroad!

Understanding Taiwan Real Estate Laws for Foreigners

When exploring Taiwan real estate law, it is crucial for foreign investors to comprehend various legal requirements for foreigners. One of the fundamental aspects to understand is the registration system. All onshore land in Taiwan must be registered except for specific cases such as land used for transportation8. This ensures transparency and legal clarity, as ownership rights are secured by the state upon registration completion8.

Foreigners are permitted to own real estate in Taiwan, subject to government approvals that are granted on a reciprocal basis8. For instance, in municipalities like Taipei and Kaohsiung, foreign individuals can purchase up to 500 square meters of land for residential use, whereas outside these municipalities, the limit extends to 1,000 square meters3. These regulations are in place to maintain a balanced property market and support Taiwan’s urban planning initiatives.

Understanding the legalities of Taiwan’s property law overview also involves grasping the rights associated with real estate. Ownership rights in Taiwan are diverse and include ownership, superficies, easement, and mortgage8. Additionally, any change in rights in rem of real estate must be registered with the land office to take effect, ensuring all transactions are legally binding8.

Taiwan operates one nationwide real estate registration system managed by competent land offices, which guarantees the registration of titles and offers a reliable process for title transfer8.

Furthermore, Taiwan’s public search system plays a pivotal role in maintaining transparency. Registered real estate ownership can be verified through a registration transcript or title deed issued by the land office8. Access to these transcripts is available online, though certain personal information is redacted to comply with data protection laws8.

Foreigners interested in the Taiwanese real estate market should also be aware that the state guarantees registered titles, providing an additional layer of security8. Transactions involving registered real estate can be partially processed electronically, adding convenience to the process, though some documents still require written submission8. In the event of errors during registration, compensation can be claimed, underlining the accountability of the registration system8.

For further details on Taiwan real estate laws, including a comprehensive property law overview, you can visit this link3.

| Municipality | Land Purchase Limit for Foreigners (Residential Use) |

|---|---|

| Taipei & Kaohsiung | 500 square meters |

| Other Locations | 1,000 square meters |

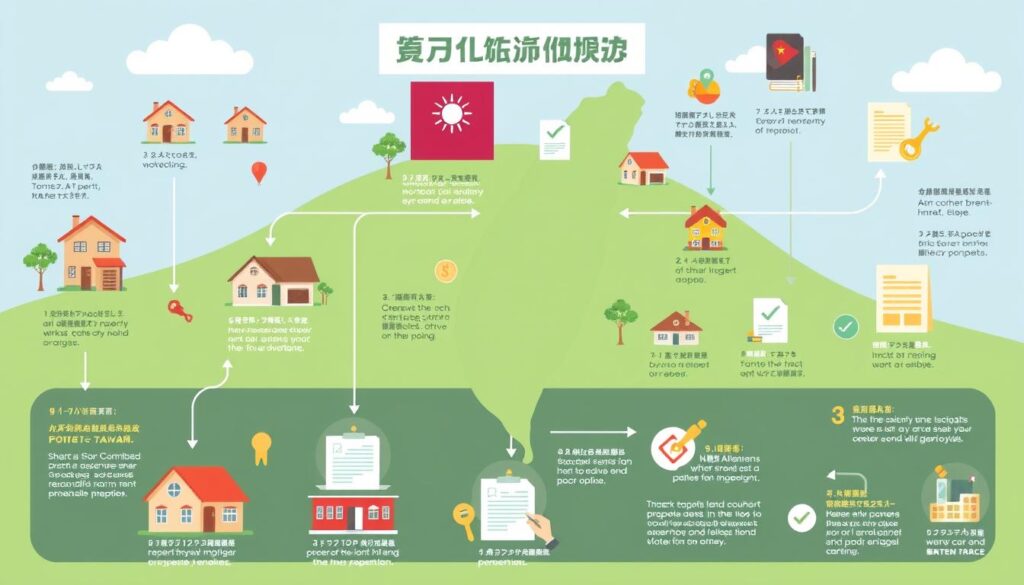

Step-by-Step Guide to Buying Property as a Non-Taiwanese Resident

The property purchase procedure for foreign home ownership in Taiwan involves several steps from finding the right property to finalizing the purchase. Understanding each element in this guide to buying property will help you navigate the process smoothly.

Finding a Property

One of the first steps in your guide to buying property in Taiwan is locating the ideal home. Online platforms like 591.com offer extensive listings that cater to various needs and budgets. Considerations such as proximity to MRT stations significantly influence desirability and rental prospects9. Keep in mind that properties close to these stations often come with a higher price tag due to their convenience10. For foreign home ownership in Taiwan, doing thorough research and consulting local real estate agents can make the search more efficient.

Making an Offer

Once you find a suitable property, the next step is making an offer. This phase of the property purchase procedure involves legal and financial consultations. It’s crucial to ensure all necessary documents, such as identification and proof of financial stability, are in order6. Banks in Taiwan have varying requirements for granting mortgages to foreigners, and some may necessitate a local guarantor with a Taiwan ID6. Foreseeing potential mortgage challenges and preparing extensive financial information can streamline this process.

Completing the Purchase

The final step in the guide to buying property as a non-Taiwanese resident is completing the purchase. This involves thorough due diligence on all fees, taxes, and potential renovation costs. Ensure that all conditions of the sale are clearly understood before signing any agreement. Be aware of penalties for backing out due to loan approval issues and have a detailed review of the contract6. Proper registration of the title transfer is the final milestone, making the property officially yours.

Financing Options for Foreign Buyers

For expatriates looking at mortgage options for expats and interested in financing real estate in Taiwan, understanding the local banking landscape is crucial. Taiwanese banks, such as CTBC Bank, Cathay United Bank, and Fubon, offer various home loans for foreigners depending on individual circumstances.

Securing financing from these banks requires that your home country has a reciprocal agreement with Taiwan. The mortgage rates in Taiwan generally range from 1.4% to 1.7%, though they can soar as high as 1.75% in some cases11.

While some banks in Taiwan do not require a guarantor for mortgages, they may request the property address and potentially your ID during the mortgage discussions11. In addition, the age and value of the property often dictate down payment requirements, with older structures typically needing higher down payments. A down payment of 40% or more can significantly improve your chances of securing a loan11.

Interestingly, property prices in Taipei are notably high, with the cost estimated at around US$7,000 per square meter or US$650 per square foot12. As a result, a modest 100-square-meter two-bedroom property in Taipei would approximate US$700,00012. This disparity between property values and the average monthly income, which is just over US$1,500 for a Taiwanese citizen12, showcases the financial challenges.

When considering mortgage options for expats, it is vital to remain vigilant about potential local ID requirements, especially if employed by specific entities in Taiwan11. Thorough research and professional consultation can significantly aid in navigating the complexities of financing real estate in Taiwan.

Taxes and Fees Associated with Buying Real Estate in Taiwan

When purchasing real estate in Taiwan, buyers should be aware of various taxes and fees that may affect their overall budget. These include deed tax, stamp duty, and government registration fees. Foreign buyers must incorporate these potential expenses into their financial planning to ensure a smooth transaction.

Deed Tax

The deed tax in Taiwan is a critical component in the real estate taxes in Taiwan. It is levied at 6% of the assessed building value, impacting the overall purchasing costs for expats13. This could result in a considerable expense, particularly for high-value properties.

Stamp Duty

Another essential tax to consider is the stamp duty, which applies to the contract value and is typically divided between the buyer and the seller. This duty is relatively modest at 0.1% of the contract value but is still a necessary consideration in the total property transaction fees13. Proper allocation of this cost helps streamline the purchasing process for both parties.

Government Registration Fees

Government registration fees are also vital in ensuring the legal documentation of property transactions. These fees cover the administrative processes involved in officially registering the property under the buyer’s name. Besides these primary taxes, buyers should also be prepared to cover additional expenses such as agent fees, legal fees, and potential renovation costs, further increasing the purchasing costs for expats13.

Overall, understanding these taxes and fees is crucial for effectively managing the property transaction fees in Taiwan. With meticulous planning and a comprehensive budget, foreign buyers can navigate these costs and secure their real estate investments successfully.

Contact us if you are Interested in Buying Property Abroad!

FAQ

Can foreigners buy real estate in Taiwan?

Yes, foreigners, excluding individuals and companies from the People’s Republic of China, can own real estate in Taiwan. However, the purchase is subject to government approvals based on reciprocal agreements between Taiwan and the foreigner’s home country.

What is the legal framework for foreign ownership in Taiwan?

Foreigners are allowed to own real estate and shares in property-owning companies in Taiwan. Ownership must be registered with the local land office, and changes in ownership also require registration updates according to Taiwan real estate laws for foreigners.

What are reciprocal agreements, and why are they important?

Reciprocal agreements are treaties between Taiwan and other countries that grant mutual property ownership rights. Foreigners must ensure that their home country has such an agreement with Taiwan to be eligible to purchase property.

How can foreigners buy property in Taiwan?

The process involves selecting a property, understanding local laws, and making a financial plan. Engaging legal, financial, and technical advisors for due diligence and employing a scrivener for tax and title transfer duties are common practices. The process concludes with the official registration of the title transfer.

What are the visa and residency requirements for buying property in Taiwan?

Owning property in Taiwan does not automatically grant residency rights. Foreigners should consult local authorities or legal advisors to understand how property acquisition may impact their visa or residency status.

What types of real estate can foreigners purchase in Taiwan?

Foreigners can invest in various types of properties, including residential and commercial real estate. This includes apartments, houses, and office buildings. However, purchasing high-value residential real estate in major cities may be subject to certain loan-to-value ratios.

What are the legal requirements for foreigners in the Taiwan real estate market?

Foreign real estate ownership in Taiwan necessitates local registration. The real estate is registered with the land office, and full ownership is contingent upon registration completion. Data protection laws may redact full names of individual owners in public search results.

What is the step-by-step guide to buying property as a non-Taiwanese resident?

The purchase process begins with finding a property, using online platforms like 591.com. Making an offer involves legal and financial consultations, followed by thorough due diligence on all fees, taxes, and potential renovation costs. The process concludes with the official registration of the title transfer.

Can foreigners secure financing from Taiwanese banks?

Yes, foreigners can secure financing from Taiwanese banks if their home country has a reciprocal agreement with Taiwan. Loan terms vary and depend on individual financial records. The age and value of the property often dictate down payment requirements.

What taxes and fees are associated with buying real estate in Taiwan?

Buyers must factor in deed tax, stamp duty, and government registration fees. The deed tax is levied on the building value, while stamp duty applies to the contract value split between buyer and seller. Additional fees include agent, legal, and registration fees, along with potential renovation and parking space costs.

Source Links

- https://multilaw.com/Multilaw/Multilaw/RealEstate/Real_Estate_Guide_Taiwan.aspx

- https://www.state.gov/reports/2023-investment-climate-statements/taiwan/

- https://www.expatfocus.com/taiwan/guide/taiwan-buying-property

- https://www.investasian.com/property-investment/taiwan-real-estate/

- https://nomadcapitalist.com/global-citizen/second-passport/taiwanese-visas-citizenship-guide/

- https://tw.forumosa.com/t/can-a-nwohr-buy-a-house-in-taiwan/187340

- https://www.investasian.com/property-investment/countries-where-foreigners-own-land/

- https://iclg.com/practice-areas/real-estate-laws-and-regulations/taiwan

- https://taiwangoldcard.com/goldcard-holders-faq/life-in-taiwan/

- https://foreignersintaiwan.com/blog/my-experience-buying-a-house-as-a-foreigner-in-taiwan

- https://tw.forumosa.com/t/buying-property-needing-alteration-on-a-mortgage-in-taiwan-for-foreigners/211149

- https://investmentsforexpats.com/taiwan-a-great-place-to-invest-in-real-estate/

- https://www.grantthornton.tw/globalassets/1.-member-firms/taiwan/media/tw_images/publication-pdf/miscellaneous/2017-05.pdf

Comments