Monaco’s real estate scene draws both investors and homebuyers. This country offers luxury and a great chance for investment. Despite being less than 1 square mile, it’s packed with wealthy people. To be in the top 1% club, you need $12.4 million12. Properties here are in high demand. They are pricier than those in New York and Paris, with costs over €50,000 per square meter2.

When looking to buy in Monaco, it’s important to know your financial options. You’ll need a 10% deposit and about 6% for fees on secondhand homes. There are also other costs, depending on the property1. This guide provides tips and steps for a successful investment in a very exclusive market.

Key Takeaways: How to get a Mortgage in Monaco

- Monaco’s real estate market is exceptionally lucrative, with soaring property prices and high demand.

- Potential buyers need to prepare a deposit typically around 10% of the purchase price.

- Understanding total ownership costs is crucial for budgeting in this competitive market.

- Various financing options are available, including traditional mortgages and private banking solutions.

- The buying process can be completed in a few days, but typically takes longer due to necessary legal steps.

Contact us to get a Financing Quote for a Property Abroad

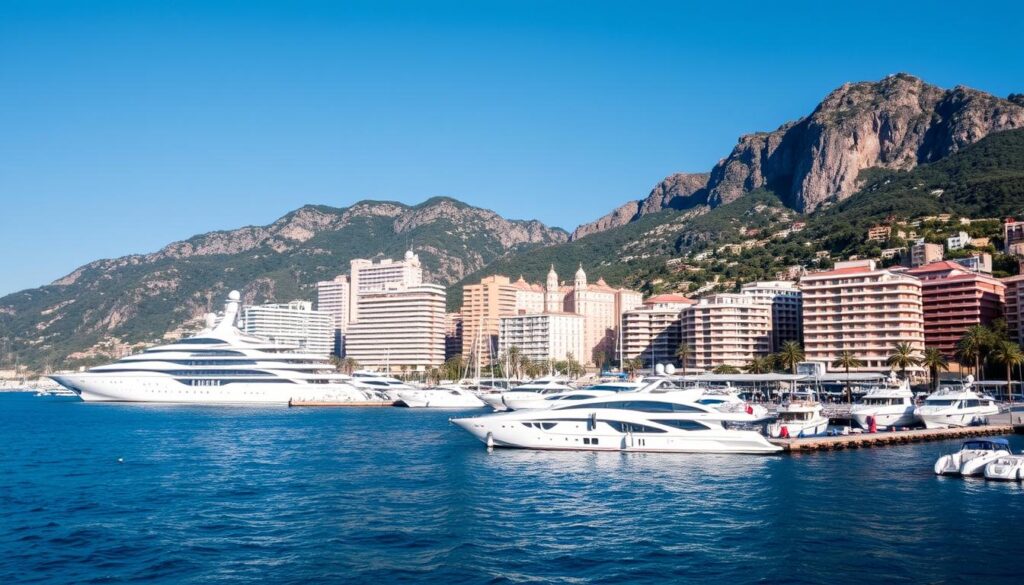

The Allure of Monaco’s Real Estate Market

Monaco draws in those seeking luxury and a chance to invest due to its great lifestyle and economic strength. The area, with its scarce land and tough building rules, keeps its real estate market unique and coveted3. The high prices of properties are mainly because there’s a strong demand for luxury places but not many are available3. This rich setting attracts individuals with a lot of wealth who want to invest in Monaco’s real estate, making it a wise decision for securing their financial future.

Luxury Living and Investment Opportunities

Monaco’s property market shines with luxury living opportunities. It has seen property sales values soar by more than 500% since 20104. In 2022, the market hit a €3.5 billion transaction volume, proving it’s thriving4. Investors see good rental incomes, with rents up 24% last year to €110 per square meter monthly4. High-end properties, worth over €10 million, saw a 50% sales jump last year, showing the market’s strength4.

Market Dynamics: Demand vs. Supply

Monaco’s property scene is a battle between demand and the little available land. This push and pull have lifted average prices in the Larvotto area to €62,000 per square meter in 20224. New developments made up 34% of all sales last year, a significant increase from an 8% average since 20064. This setting is great for investors, offering chances for residency or citizenship in Monaco, a key benefit of investing here3.

Understanding the Buying Process in Monaco

Buying property in Monaco starts with knowing the steps involved. The first step is to find the right property. You might need help from an agent who knows the local market well. When you find a property you like, you prepare a written offer. This leads to the Compromis de Vente, or preliminary agreement. It makes sure the buyer and seller agree on the price and conditions.

Steps to Purchase Property

The steps to buy property in Monaco are clear and straightforward. They are set to keep things open and efficient. Here are the main steps:

- Start by finding the perfect property, often with an agent’s help.

- Next, make a formal written offer. It needs acceptance to proceed.

- Then hire a notaire, crucial for handling the legal stuff.

- Sign the Compromis de Vente, which lists the price and terms before the final deed.

- Finally, take care of the money part. This may include looking into Monaco property finance options to stay on budget.

Role of Notaires in Real Estate Transactions

In Monaco, notaires play a key role in real estate deals. They protect everyone’s interests. They make sure all legal steps are followed during the sale. They handle due diligence and prepare the final sales deed. This is very important in Monaco, where real estate prices are high. Agencies often take a three percent fee, and notaire fees can be around six percent. Knowing these costs helps you understand the buying process better5.

Financing Property in Monaco: Overview of Options

In Monaco, buyers looking into property loans have several choices. These options like bank loans, private banking, and equity release fit different budgets and plans. Understanding each type can help pick the best one for your financial situation.

Traditional Mortgages

In Monaco, traditional mortgages cover up to 85% of properties under €5 million. This lets buyers finance a large part without extra assets. Rates are competitive, between 1.5% and 2.5%. Most apartments cost around €5 million, but new ones can go over €13.5 million. This makes traditional loans a popular option for entering Monaco’s luxury market67.

Private Banking Solutions

For wealthy buyers, private banking in Monaco provides personalized finance services. These may include loans covered by managed assets for purchases over €5 million. Luxury-focused banks offer products designed for the wealthy’s unique needs and lifestyle.

Equity Release Schemes

Equity release schemes in Monaco offer a way to use your home’s value creatively. This option is great for investing in more properties without losing flexibility. It lets owners grow their portfolio without selling their current assets.

Determining Your Budget for Property Investment

Making a budget is a key step for those thinking about investing in Monaco property. You need to know the full costs of owning a property. These include the buying price, legal costs, taxes, and upkeep expenses. Prices can change a lot based on the property and its location. This is because Monaco has very few properties and lots of people want to live there, which makes prices for fancy homes go up8/9.

Understanding Total Ownership Costs

The total costs of owning property in Monaco aren’t just the buying price. You should also think about extra costs like upkeep and fixing up the place. Monaco’s properties often have fancy features, like help from a concierge or gyms. These features can make people want to buy them8. The average price per square meter is more than 47,000 Euros. So, it’s really important to make a careful budget. This helps you avoid spending more money than you expected9.

Setting Realistic Expectations for Financing

When it comes to financing, it’s important to have realistic goals in Monaco. Knowing about the market, interest rates, and how much your property might go up in value will help you make good choices. It’s a good idea to get advice on legal and financial matters early on. This way, you can look at all sides of financing your property10.

In Monaco, there are no taxes on property, capital gains, or personal income. This makes it a great place for investment. A lot of wealthy people like buying property here because of the good tax situation9. By thinking about all these things and matching them to your financial goals, you can make smart choices. This will help you do well in Monaco’s complex property investment field.

| Cost Component | Estimated Amount |

|---|---|

| Purchase Price (average per square meter) | 47,000 Euros |

| Legal Fees | Approximately 1-2% of purchase price |

| Maintenance Fees | Variable based on property |

| Renovation Costs | Variable based on property state |

For a deeper look into the buying process, there are detailed guides. They offer vital steps for buying property in Monaco checklist of key steps8910.

Contact us to get a Financing Quote for a Property Abroad

Making an Offer: Key Considerations

When you’re ready to buy a place in Monaco, making offers Monaco is a big step. You must pick the right place and then give a written offer. This should say how much you want to pay and when you need an answer, usually in 2-5 days. Remember, in Monaco, once your offer is accepted, you can’t change your mind without facing issues.

Knowing the financial risks is key, as backing out after the offer is accepted can cause legal problems. To improve your chances during Monaco property negotiations, think about including conditions related to financing. This gives you some wiggle room based on loan approvals or unexpected events.

A 10% deposit is needed with your offer. Later, you will need to pay around 6% of the final price for registration and notary fees. Plus, expect to pay the real estate agency 3% of the purchase price, and then add 20% VAT on their fee. Working with a local real estate expert can help you handle these steps and make sure you follow the rules.

| Cost Type | Percentage |

|---|---|

| Deposit for Offer | 10% |

| Registration & Notary Fees | 6% |

| Agency Commission (Buyer) | 3% + VAT 20% |

| Agency Commission (Seller) | 5% + VAT 20% |

For extra help with offers and buying property, check out this resource.

Choosing the Right Financial Advisor

Finding the right financial advisor is key for success in Monaco’s property market. An expert can greatly improve your finance experience by providing personalized solutions. They also offer deep insights into local customs.

This expertise is essential for navigating complex finance issues and snagging top deals.

The Importance of Expertise

Teaming up with an informed financial advisor in Monaco opens up the world of local financing options. With property prices averaging €48,800 per square meter, buyers really benefit from expert mortgage advice11. An advisor’s knowledge of Barclays Monaco and Société Générale Monaco helps find the best mortgage options12.

Finding a Broker Familiar with Monaco’s Market

Choosing a broker with regional experience is crucial. The right broker offers top real estate advice Monaco, fitting high-net-worth individuals’ needs. They help you navigate second-charge mortgages and bridging finances, finding you the best deals13.

A clear relationship with your advisor is key to a smooth property buy13.

Navigating the Legal Landscape of Property Financing

Monaco’s legal landscape offers a unique setting for property financing, with specific property regulations Monaco guiding all transactions. When entering this elite market, buyers must fully understand their obligations. They need to grasp the legal aspects of real estate ownership. This is vital for meeting complex requirements like land registry processes.

It’s also essential to understand the taxation rules. This knowledge helps in navigating the intricacies and protecting one’s investment.

Key Regulations and Requirements

In Monaco, the limited space—only 2.02 square kilometers—makes legal advice crucial for potential buyers14. Buyers should know that property registration fees are about 6% of the property’s value14. Notary fees for transactions can vary from 1% to 3% of the price14.

Knowing these fees beforehand can simplify the financing process.

Understanding Your Rights as a Buyer

Knowing buyer rights Monaco is critical for anyone considering a purchase. Legal rules aim to protect buyers, ensuring clear and fair transactions. It covers establishing straightforward agreements and guarding against scams. Buyers should also learn about leasehold ownership terms, often lasting between 18 and 99 years14.

Getting advice from legal experts can also help buyers make informed choices. It ensures they are well-prepared for their property financing journey.

For further details on navigating property purchase, check this detailed guide15.

Common Challenges in Property Financing

Financing property in Monaco has its unique challenges, especially for non-residents. Non-residents face stricter lending criteria that complicate getting a mortgage. They also have limited access to mortgage options, making it hard to find good deals in the real estate market. Monaco’s strict banking rules add to these challenges, limiting how banks work in the area16.

Challenges Faced by Non-Residents

Non-residents struggle with Monaco’s high interest rates. High-value property loans are often tied to EURIBOR rates, increasing the financing cost16. A loan-to-value ratio (LTV) up to 85% for properties valued at €5 million can help some buyers17. Yet, many non-residents miss out on this benefit due to the lack of a local financial history.

High Interest Rates in Monaco

Monaco’s high interest rates are a big hurdle for homebuyers. The current rate for real estate loans is at 1.75% per year. However, rates can change with the market and regulations16. The Monegasque Criminal Code stops lenders from setting rates too high. This law and fluctuating rates make financing in Monaco a challenge16.

Because of this, thorough preparation and seeking advice from a financial advisor is key. Such guidance can greatly improve your chances of getting a good financing deal. It helps you navigate the complex property financing in Monaco16.

Conclusion

Buying property in Monaco is complex and needs good planning and understanding. The real estate market there is stable and growing, despite Monaco’s small size. It’s very important to work with experts when buying property in Monaco. This place offers great tax benefits, like no income tax, wealth tax, or capital gains tax. These perks make it a top spot for investing in real estate18.

When looking to buy here, buyers must think carefully about how to finance their purchase. Things like how much to put down, loan terms, and your debt compared to your income matter a lot. With the high cost of about €100,000 for each square meter, knowing all your costs and what you can really afford is key19. Helpful platforms like Petrini make finding luxury properties easier.

To do well in Monaco’s unique market, understanding local laws and managing your budget well are important. Monaco’s stable government and great tax laws are why it’s a top place for property investment. This makes buying property in Monaco very appealing for smart investors1819.

Contact us to get a Financing Quote for a Property Abroad

FAQ

What is the average down payment required for a property loan in Monaco?

When getting a property loan in Monaco, buyers usually pay 30% to 50% of the home’s value upfront.

Are there special financing options for non-residents looking to buy in Monaco?

Non-residents might find it harder to get a mortgage and have fewer options. However, private banks sometimes offer special finance solutions for wealthy individuals.

How are real estate taxes calculated in Monaco?

In Monaco, there’s no tax on the profit from selling a house. But buying one includes fees like registration and notary charges. These usually add up to about 7% of the purchase price.

What role does a notaire play in the process of buying property in Monaco?

In Monaco, a notaire is essential. They make sure everything is legal, do thorough checks, and get the final sale papers ready. This ensures a sale that’s both clear and secure.

What should I consider when budgeting for property ownership in Monaco?

When planning to own property in Monaco, think about all costs. This includes legal fees, taxes, keeping the place up, and any loan costs. Planning this way helps create a full budget for owning property in Monaco.

Can I negotiate the interest rates on my mortgage in Monaco?

Yes, you can negotiate mortgage rates in Monaco. They might be higher than elsewhere, but lenders could offer better rates based on your finances and the type of house you’re buying.

What financing options are available for property investments in Monaco?

For property investments in Monaco, you can get traditional mortgages, private bank loans tailored to you, and equity release plans. These allow using the value already in your home to invest more.

What makes Monaco a unique real estate market for investment?

Monaco stands out for its high demand, limited availability, stable property prices, and special tax rules. This makes it appealing for wealthy buyers and investors looking for a good opportunity.

Source Links

- https://www.home-hunts.com/blog/guide-to-buying-property-in-monaco/

- https://www.finbri.co.uk/bridging-loan/bridging-loan-guides/buying-property-in-monaco

- https://www.monacoproperties.mc/en/monaco-real-estate-allure-investment.html

- https://monaco-serviceazur.com/en/info/articles/rynok-nedvizhimosti-monako/

- https://www.linkedin.com/pulse/insider-knowledge-how-buy-property-monaco-zsolt-szemerszky

- https://www.ennessglobal.com/mc/services/monaco-mortgages

- https://ybcase.com/en/company-services/real-estate/rukovodstvo-po-pokupke-nedvizimosti-v-monako

- https://carolineolds.com/10-essential-tips-for-buying-property-in-monaco-your-insiders-guide/

- https://theimperium.life/featured/guide-to-buying-property-in-monaco

- https://monacolife.net/real-estate-essential-insights-for-navigating-the-property-market-in-monaco/

- https://monaco-real-estates.com/financing-the-purchase-of-property-in-monaco-options-and-practical-advice/

- https://www.expatfocus.com/monaco/guide/monaco-property-financing

- https://livinginmonaco.com/forums/topic/real-estate-mortgage/

- https://mgz.com.tw/2024/09/09/real-estate-law-in-monaco-navigating-one-of-the-worlds-most-prestigious-markets/

- https://www.monacoproperties.mc/en/monaco-real-estate-guidance.html

- https://www.lexology.com/library/detail.aspx?g=d2ae05ee-2aaa-4201-8258-fe9639d1b8c6

- https://medium.com/@ennessmortgages/monaco-mortgage-and-property-market-d91c000e6096

- https://www.introducertoday.co.uk/article/2023/12/investing-in-monaco-what-are-the-advantages/

- https://romanointernational.com/investing-in-monaco-real-estate/

Comments