Last Updated on: 2nd February 2025, 03:36 pm

Exploring inheritance tax-free countries can provide significant advantages for those considering where to inherit money tax-free. As of 2025, several nations have abolished the inheritance tax, presenting valuable opportunities for estate planning and wealth preservation. This comprehensive comparison highlights the countries with no inheritance tax, allowing readers to make informed decisions regarding the implications of such policies on estates and heirs globally.

While some countries like Germany impose substantial inheritance tax rates, reaching up to 50% depending on the inheritance value and relationship1, others like Poland entirely do not have inheritance tax regulations in place1. Nations with no estate tax often present better economic growth and attract more high-net-worth individuals, exemplifying the financial freedoms available in these jurisdictions2. Distinct from many global regions, countries such as Qatar do not levy inheritance taxes, making them financially appealing for heirs1.

Contrasts can be drawn with countries like Belgium, where inheritance tax rates fluctuate dramatically based on the region and relationship between the deceased and beneficiary1. Furthermore, the percentage change in the number of nations without inheritance tax compared to the previous year illustrates a growing trend toward tax leniencies in multiple regions2. By comprehending these dynamics, individuals can better navigate the landscape of global inheritance taxation in 2025.

Key Takeaways

- Analyzing countries with no inheritance tax can reveal significant financial advantages.

- Germany has a high inheritance tax rate, up to 50%, highlighting the benefit of tax-free alternatives1.

- Poland and Qatar are examples of nations without inheritance tax, offering appealing options for wealth preservation1.

- The absence of inheritance tax can promote economic growth and attract high-net-worth individuals2.

- Annual variations show an increasing number of countries eliminating inheritance taxes, enhancing global estate planning flexibility2.

Contact us if you are Interested in Buying Property Abroad!

Introduction to Inheritance Tax

Understanding inheritance tax is crucial as it directly impacts how wealth is transferred across generations and affects the global wealth distribution. This tax can significantly influence financial planning and the tax advantages for heirs.

Definition and Importance

Inheritance tax is defined as a levy on the estate left by a deceased person. It is vital for understanding its potential impact on inheritance and the tax advantages for heirs. For example, in the United States in 2025, the estate tax exemption threshold is set at US$13.61 million per person and US$27.22 million for married couples, with tax rates ranging from 18% to 40% for estates exceeding this value3. Globally, inheritance, estate, and gift taxes form a minor part of national revenues, emphasizing the strategic implications of inheriting in different jurisdictions.

Global Perspectives

The approach to inheritance tax varies significantly worldwide. Japan, for instance, imposes the world’s highest estate tax rate of 55%, applicable to everyone including non-resident citizens and long-term expats3. In contrast, fifteen OECD member countries waive death tax for property transfers to close family members or lineal heirs, although some exceptions may apply4. Countries like Australia abolished their inheritance tax in 1985, though inherited assets might be subject to capital gains tax upon sale3.

Here’s a comparative look at inheritance tax rates in various countries:

| Country | Top Estate/Inheritance Tax Rate | Notes |

|---|---|---|

| United States | 40% | Exemption thresholds: US$13.61 million per person, US$27.22 million for married couples3 |

| Japan | 55% | Highest rate globally, applicable to non-residents too35 |

| South Korea | 50% | High but lower than Japan’s rate3 |

| France | 45% | Tax-free up to €100,000 for close family5 |

| Germany | 50% | Exemption for smaller bequests ranging from €20,000 to €500,0005 |

The variance in inheritance tax rates and structures across nations supports the need for strategic estate planning. Countries like Sweden and Portugal have even abolished their inheritance or estate taxes since 2000, reflecting broader trends towards simplifying wealth transfer and encouraging economic growth4. Understanding these global perspectives can help heirs and benefactors navigate the complexities of inheritance and leverage the tax advantages for heirs effectively.

Inheritance Tax Trends in 2025

In 2025, several notable trends have emerged in inheritance tax policies worldwide, reflecting evolving economic landscapes and perspectives on wealth distribution. Understanding these trends is crucial for grasping the broader implications on both individual wealth and national economies.

Recent Changes

Recent changes in inheritance tax policies have seen numerous countries either abolishing or reforming these taxes. As of 2023, out of 35 major European countries, 24 levy estate, inheritance, or gift taxes6. Countries like Belgium have comprehensive inheritance tax structures with rates ranging from 3% to a staggering 80%6. Conversely, nations such as Croatia maintain a more straightforward approach with a flat inheritance tax rate of 4%6. Additionally, Denmark’s inheritance tax rates vary significantly, from 0% to 52%6.

The variance in inheritance tax rates across Europe highlights the diverse approaches countries adopt towards wealth distribution and tax collection. The OECD reports that well-structured inheritance taxes have the potential to address inequality and create more equitable opportunities across various wealth brackets7. Furthermore, data indicates that Belgium and France generate more than 1% of their total tax revenues from inheritance, estate, and gift taxes7.

Impact on Global Wealth Distribution

The impact on wealth distribution due to recent changes in inheritance tax policies has been significant. In 2020-21, only around 4% of deaths resulted in inheritance tax liabilities, but this figure is projected to rise to over 7% by 2032-338. By that time, it’s estimated that one in eight individuals (12%) will be subject to inheritance tax upon their death or the death of their spouse8. These projections suggest a considerable shift in the financial landscape, with increasing inheritance tax revenues expected to rise to over £15 billion annually by 2032-338.

The trend towards higher inheritance tax revenues is driven partly by the exclusion of various familial and asset-specific exemptions traditionally afforded to close relatives. This change underscores the need for updated examination of tax exemptions for inheritances to assess their effectiveness in contemporary contexts7. Addressing the loopholes and reforms such as abolishing the residence nil-rate band could collectively generate an extra £1½ billion annually, highlighting the crucial role such reforms play in shaping global wealth dynamics8.

The statistics indicate that tax exemptions for inheritances and recent changes in inheritance tax policies could fundamentally alter wealth distribution patterns globally. These changes underline the pressing need for governments to reassess current structures to better harness the potential of inheritance taxes to enhance economic equality.

Benefits of Countries With No Inheritance Tax

Countries that do not impose inheritance taxes offer numerous financial benefits for heirs, which can lead to substantial economic growth. This tax exemption allows heirs to retain the full value of inherited assets, avoiding the high tax rates seen in some regions. For example, in Belgium’s Brussels capital region, a non-relative may need to pay up to 80% of the inherited wealth to the government, while a sibling might owe up to 65%9. In contrast, countries like Hong Kong, Singapore, Portugal, Slovakia, Estonia, Mexico, Canada, and New Zealand do not levy inheritance taxes, enhancing the financial advantages for heirs9.

Financial Advantages for Heirs

The primary financial advantage of inheriting in tax-free inheritance countries is the substantial tax savings. By not having to pay estate taxes, heirs are able to retain and potentially increase the value of their inherited assets. This could be particularly advantageous in places like the United States, where only 0.08% of the population pays death taxes due to the exemption being raised to $11 million10. Similarly, Singapore abolished its inheritance tax in 2008, which has led to significant economic benefits and an increase in foreign investors910. Such tax advantages for heirs allow them to reinvest these funds into various economic activities, further driving economic benefits.

Encouragement of Economic Growth

The economic benefits of no estate tax extend beyond individual financial gains, stimulating broader economic growth. Without the burden of inheritance taxes, funds remain in the private sector, where they can be re-invested into businesses and other ventures. For instance, Australia’s elimination of the federal estate tax in 1979 contributed to substantial capital inflows, attracting high-net-worth individuals and fostering business investments910. Moreover, the productivity of capital is maximized as fewer assets are diverted to pay taxes, enhancing the overall economic benefits of no estate tax. This logic is evident in Singapore, where the abolishment of inheritance tax resulted in an increase in family offices and significant amounts of assets under management by foreign investors10.

Countries in Europe With No Inheritance Tax

Many European inheritance tax free countries present valuable opportunities for individuals seeking to transfer wealth without the burden of estate taxes. The absence of these taxes can be financially advantageous for heirs and can encourage economic growth within these regions. Below is a detailed overview of some estate tax free nations Europe.

Detailed List of European Nations

The European landscape of countries without death tax includes several prominent nations:

- Austria

- Cyprus

- Estonia

- Latvia

- Malta

- Romania

- Slovakia

- Sweden

- Norway (part of EFTA)

In these countries, heirs can receive their inheritance without the financial strain that comes from high tax rates, making them attractive options for wealth transfer. For example, since 2022, eight European Union countries—Austria, Cyprus, Estonia, Latvia, Malta, Romania, Slovakia, and Sweden—had no inheritance, estate, and gift taxes, which significantly benefits their residents11. Norway, part of the European Free Trade Association (EFTA), also does not levy inheritance tax, further simplifying wealth transfer for its citizens12.

Economic Impacts in These Countries

The absence of inheritance taxes in these countries has various economic impacts. For instance, the presence of wealth tax in Norway is structured to ensure fairness in wealth distribution, with rates of 0.95 percent on net wealth above 1.7 million kr ($162,000) up to 2 million kr ($190,000), and 1.1 percent on net wealth above 2 million kr ($190,000)12. Such policies balance the benefits of having no inheritance tax while ensuring that higher net worth individuals contribute fairly to the economy.

Moreover, the countries without death tax, like Austria and Slovakia, allow for more significant economic mobility and financial security for heirs, potentially increasing consumer spending and investment within these regions. This environment fosters economic growth and can attract international investments looking to capitalize on the favorable tax conditions11. Countries such as Monaco, which offers no inheritance, capital gains, or wealth tax, provide an attractive business environment, allowing corporations to thrive with tax exemptions and substantial economic incentives12.

These dynamics illustrate how estate tax free nations Europe can adapt their fiscal policies to draw in wealth, stimulate economic growth, and foster a thriving financial ecosystem for both individuals and businesses alike.

Contact us if you are Interested in Buying Property Abroad!

Countries in Asia With No Inheritance Tax

Several Asian countries have attracted attention due to their policies on inheritance tax, which can significantly influence wealth transfer and estate planning strategies. These countries, by avoiding inheritance tax, create favorable conditions for residents and foreign investors alike.

Detailed List of Asian Nations

Among the Asian countries without inheritance tax, notable examples include Hong Kong and Macau SARs. These regions have chosen to eliminate such taxes to foster economic growth and attract global investors looking for tax-free inheritance opportunities. Malaysia also abolished inheritance tax back in 1991, which previously taxed net worth exceeding MYR 2 million and MYR 4 million at rates of 5% and 10%, respectively13. Similarly, Singapore removed its Estate Duty tax before 2008 to enhance its investment climate14. Laos and Myanmar are other examples, as neither country imposes inheritance taxes13. These policies make these tax-free inheritance Asian nations appealing for wealth transfer plans.

Economic Impacts in These Countries

The economic impacts of such tax policies are significant. By eliminating inheritance tax, these Asian countries can attract more investments and encourage wealth transfer methods that benefit their economies. Malaysia experienced considerable economic growth after abolishing its inheritance tax, making it a lucrative destination for estate planning13. The absence of inheritance taxes in countries like Cambodia, where non-resident investors too benefit through strategic arrangements, also stimulates local economies and real estate markets13. Moreover, Vietnam’s flat 10% inheritance tax on properties surpassing VND 10 million, with specific exemptions based on relationships, offers a balanced approach catering to both economic growth and revenue generation13. These policies foster a more attractive economic environment for both local residents and international investors looking at Asia wealth transfer taxation.

To explore more about the inheritance tax policies in Asian countries, you can visit this detailed list.

Countries in Africa With No Inheritance Tax

Africa’s approach to inheritance tax is varied, with some nations opting not to levy this tax, allowing their citizens to inherit without taxes Africa. This section delves into the African nations with no estate tax and explores the economic impacts of these tax policies in Africa.

Detailed List of African Nations

Several African countries do not impose an inheritance tax, fostering an environment where heirs can inherit without taxes Africa. Among these are:

- South Africa

- Swaziland

- Namibia

- Gabon

- Kenya

These countries allow for smoother wealth transfer and offer significant financial advantages for heirs.

Economic Impacts in These Countries

The absence of inheritance tax in these African nations plays a crucial role in their overall economic strategies. For instance, by enabling heirs to inherit without taxes Africa, these countries aim to enhance wealth retention amongst their citizens, which can lead to increased domestic investments and sustained economic growth.

South Africa, with its relatively lower inheritance tax rate of 25% compared to several other countries like Belgium (80%) and Japan (55%), exemplifies how differing tax policies in Africa can influence economic dynamics15. Holding companies in the region can take advantage of lighter taxation rates for inheritance purposes, promoting easier property management and succession planning15.

In conclusion, the lack of inheritance tax in specific African nations promotes financial stability for heirs and contributes positively to the economic fabric of these countries by allowing for more substantial investments and sustained growth.

| Country | Inheritance Tax Rate | Economic Impact |

|---|---|---|

| South Africa | 0% | Encourages wealth retention and investments |

| Swaziland | 0% | Enhances domestic stability and economic growth |

| Namibia | 0% | Promotes financial advantages for heirs |

| Gabon | 0% | Fosters economic development through investments |

| Kenya | 0% | Encourages wealth distribution within families |

Countries in the Americas With No Inheritance Tax

Several American countries display unique tax policies, making them attractive options for those looking to benefit from tax exemptions for inheritances Americas. These policies are particularly relevant as we observe inheritance tax trends America, enabling better estate planning and wealth transfer.

Detailed List of American Nations

Understanding the distinct tax regimes in each country is important for navigating the American countries with no death tax. Below is a detailed look at some of these nations:

- Costa Rica: Costa Rica operates on a territorial tax code, meaning only income earned within the country is subject to tax, and corporate tax rates range from 5% to 30%. Foreign-sourced income remains tax-free16.

- Panama: Panama also adheres to a territorial tax system, taxing only local income with rates ranging from 0% to 25%. Foreign-earned income is entirely exempt16.

- Paraguay: In Paraguay, permanent residency can be secured with a deposit of US$4,500, and its territorial tax system exempts income earned outside the territory16.

Economic Impacts in These Countries

These American countries with no death tax create substantial economic advantages for both residents and non-residents. By examining inheritance tax trends America, one can see a significant boost in foreign investments and economic growth.

- Costa Rica: Thanks to its territorial tax policy, Costa Rica attracts high net worth individuals and businesses seeking a favorable tax environment16.

- Panama: The exemption of foreign-earned income has made Panama a hub for multinational corporations and wealthy expatriates, stimulating various sectors of the economy16.

- Paraguay: With a minimal residency investment and a favorable tax structure, Paraguay incentivizes both local and foreign investments, contributing to steady economic growth16.

| Country | Tax System | Incentives |

|---|---|---|

| Costa Rica | Territorial | Tax-free foreign income16 |

| Panama | Territorial | 0% tax on foreign income within 0%-25% range16 |

| Paraguay | Territorial | Residency with US$4,500 deposit16 |

How to Benefit from Inheriting in Tax-Free Countries

Benefiting from inheriting in tax-free countries can be complex yet rewarding. A clear understanding of legal aspects and investment opportunities is vital for maximizing the advantages.

Legal Considerations

First and foremost, understanding the legal steps for international inheritance is essential. When assets valued at over $100,000 are received from a non-U.S. person, they must be reported to the IRS using Form 3520 for gifts exceeding this amount17. Non-compliance penalties can amount to 5% of the inheritance value monthly, capping at 25%17. In the U.S., inherited assets get a stepped-up basis to their fair market value at the decedent’s death, potentially reducing capital gains tax when the assets are sold17. Additionally, U.S. beneficiaries of foreign trusts need to fill out Form 3520/3520A for the annual reporting of trust assets and distributions17.

Engaging with foreign and U.S. tax law experts is prudent to navigate the complexities of inheriting foreign assets and ensuring compliance with tax regulations. Assets outside the U.S. do not incur direct U.S. taxes, but they still need adherence to stringent IRS reporting norms17. Countries such as Austria, Germany, Italy, and the United Kingdom have estate and gift tax treaties with the U.S., which can impact cross-border transfers18. It is crucial to be aware of these treaties and their applications to avoid double taxation.

Investment Opportunities

Once the legal steps for international inheritance are well comprehended, you can explore investment opportunities post-tax-free inheritance to further capitalize on the benefits. In countries with no inheritance tax, like Australia, China, France, Japan, and Switzerland, the scope for reinvesting in local or global opportunities is substantial18. These nations offer a remarkable environment to grow the inherited assets free from additional tax burdens, promoting wealth preservation and accumulation.

Moreover, utilizing tax-free inheritance for investing can lead to significant financial growth. For instance, consider allocating these funds in diversified portfolios or focusing on sectors with steady returns. The absence of tax on inherited assets allows for a more aggressive investment strategy, enhancing potential gains. Consulting with financial advisors and leveraging their expertise ensures optimized asset allocation, considering country-specific opportunities and their financial climates.

Proper planning and strategic investment in tax-free countries can amplify the benefits of inheriting in tax-free countries, assuring better financial security and growth. To ensure compliance and optimize benefits, always consult tax and investment professionals familiar with international inheritance scenarios.

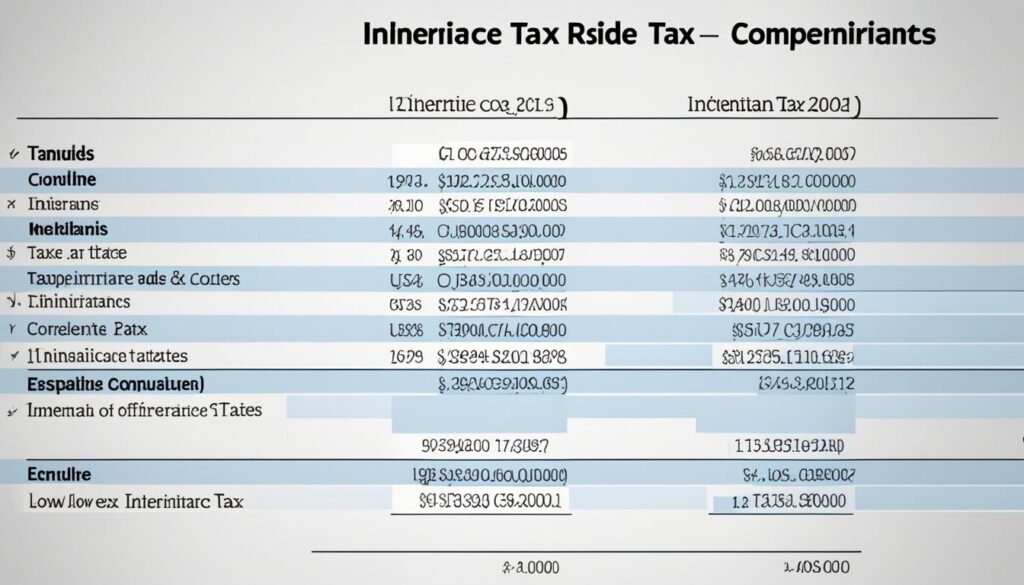

Comparative Analysis: Countries With Inheritance Tax vs. Countries With No Inheritance Tax

Comparing countries with and without inheritance tax reveals distinct variations, particularly in comparative inheritance tax rates and the strategic approaches used. These variations significantly influence estate planning strategies and decisions about asset transfer.

Tax Rates and Exemptions

Countries in the Organization for Economic Cooperation and Development (OECD) display varying inheritance tax rates. Notably, Japan has the world’s highest inheritance tax rate at 55%, followed by South Korea at 50%, and France at 45%19. In contrast, the average estate tax rate across the OECD is 15%, with a median tax rate of 7%19.

The United States ranks fourth in the OECD with an estate tax rate of 40%19. Meanwhile, fifteen OECD countries do not impose taxes on property passed to lineal heirs19. Some regions in Spain can impose inheritance tax rates as high as 88% due to varying local policies19.

Case Studies

Recent case studies on inheritances highlight the practical implications of differing inheritance tax policies. For instance, Sweden’s repealed inheritance tax in 2005 led to IKEA founder Ingvar Kamprad returning to the country after living abroad19. This illustrates how tax policies can impact personal and business decisions.

Analyses reveal that repealing the U.S. estate tax could potentially boost GDP, create 139,000 jobs, and eventually increase federal revenue by approximately $8 billion per year19. This underscores the broader economic impact of such tax policies.

Another noteworthy finding involves household wealth distribution. In OECD countries, the wealthiest 1% own 18% of household wealth, while the top 20% of households own nearly 80% of all financial wealth20. Estate planning strategies are thus crucial for managing and distributing this substantial wealth efficiently.

Furthermore, case studies on inheritances indicate that between one-quarter and one-half of households across OECD nations report receiving an inheritance or substantial gift20. Understanding these patterns can help in designing informed estate planning strategies that account for varying tax implications.

Expert Opinions on Inheritance Tax Exempt Countries

When exploring the benefits of inheritance tax-exempt countries, tax expert insights are crucial. Financial advisors often highlight how these environments offer significant advantages for wealth preservation. In our interviews with leading financial advisors, they emphasized that countries with no inheritance tax, such as Australia, Canada, and Mexico, provide unique opportunities for strategic financial planning inheritance tax considerations.

Interviews With Financial Advisors

Financial advisors from renowned firms underline that the absence of inheritance tax can be a strategic benefit for high-net-worth individuals. They pointed out that by moving assets to countries like China and Russia, which do not levy inheritance taxes, families can maintain more of their wealth across generations21. Additionally, in countries with no inheritance tax, assets are transferred seamlessly, allowing beneficiaries to invest or reinvest without the burden of hefty tax deductions22.

Insights From Tax Experts

Insights from tax experts reveal that understanding the legal frameworks and tax regulations in various countries is essential for effective financial planning inheritance tax. Tax expert insights suggest that advisors play a pivotal role in navigating these complexities and ensuring compliance while optimizing tax-free inheritance strategies. They also shed light on the varying tax rates in countries that do impose inheritance taxes, such as Belgium (4%-80%) and the UK (standard 40% on estates above £325,000)21. By choosing countries with more favorable or no inheritance tax regulations, individuals can enhance their financial legacy21.

| Country | Inheritance Tax Status | Advantage |

|---|---|---|

| Australia | No Inheritance Tax | Maximizes heir’s wealth |

| Canada | No Inheritance Tax | Simplifies asset transfer |

| China | No Inheritance Tax | Facilitates intergenerational wealth |

| Russia | No Inheritance Tax | Eliminates tax-related worries |

| Mexico | No Inheritance Tax | Streamlined inheritance process |

How to Legally Move Assets to Tax-Free Countries

Transferring assets internationally and ensuring compliance with legal procedures for asset relocation can be a complex endeavor. It’s essential to understand both the steps and the potential pitfalls to avoid legal issues or unnecessary tax burdens. Below is a detailed guideline to help you navigate this process.

Steps and Procedures

When transferring assets internationally, it’s critical to follow legally outlined procedures to ensure compliance and safeguard your wealth. Begin by consulting a legal advisor who specializes in the international relocation of assets. Legal experts can help you understand the specific laws in both your current country and the destination country.

- Inventory Assets: Create a detailed inventory of your assets, including real property, personal property, and investment accounts.

- Evaluate Tax Implications: Assess the tax implications in both countries. For instance, U.S. estate tax laws now offer a $12.06 million federal estate and gift tax lifetime exclusion amount, which can significantly impact your tax planning strategy23.

- Legal Documentation: Prepare necessary legal documents such as wills, trusts, and transfer deeds. This is particularly crucial in common law jurisdictions where more flexibility is permitted in estate planning23.

- Compliance with Local Laws: Ensure compliance with local laws in both your home country and the destination country. For example, EU inheritance laws differ significantly, and Danish and Irish citizens must navigate specific rules24.

“To avoid tax pitfalls during asset relocation, it is essential to understand the cross-border inheritance procedures inherent in multiple countries.” – Financial Advisor

Possible Pitfalls and How to Avoid Them

While transferring assets internationally can provide significant benefits, there are potential pitfalls to be aware of:

- Unintentional Non-Compliance: Failing to adhere to specific legal requirements can result in penalties or asset seizures. For example, U.S citizens must navigate interspousal transfers and the portability of unused exemptions carefully23.

- Double Taxation: Ensuring there is no overlap in tax regimes between the countries is crucial. Assessing the tax laws to understand the risk of double taxation is a fundamental step in asset relocation.

- Complex Legal Frameworks: Cross-border families often face complexity due to varying international laws. Civil law countries typically have hereditary reserve regimes, making estate planning more rigid than in common law jurisdictions23.

- Citizenship and Residency Issues: Your citizenship, residency, and domicile status can dramatically affect exposure to transfer tax regimes, necessitating a thorough understanding of these concepts23.

By following these steps and being cautious of potential pitfalls, you can effectively navigate the legal procedures for asset relocation. Always consult with professionals to ensure that your asset transfer is both compliant and optimized tax-wise.

Conclusion

In summary, the comprehensive examination of countries with no inheritance tax illustrates the strategic importance of these nations in estate planning and preserving wealth without taxes. The unique tax-free thresholds in various countries often result in significant financial advantages for heirs, encouraging economic growth and intergenerational wealth transfer. Such insights are crucial for individuals considering how to best inherit assets wisely.

The debate on inheritance tax continues to highlight the complexities surrounding its impact on social inequalities and wealth distribution25. With tax-free limits varying across different nations, strategic estate planning becomes imperative to maximize benefits and minimize tax liabilities26. Despite the potential for loopholes and challenges in navigating tax laws, selecting tax-free countries can substantively influence the preservation of family legacies.

Looking forward, it seems unlikely that a rise in inheritance tax rates will gain widespread favor among the public27. However, thoughtful planning and awareness of the differing tax implications globally remain vital for those aiming to ensure their wealth endures across generations. By considering these factors, one can lay the groundwork for sustaining prosperity and seamlessly passing on their legacy.

Contact us if you are Interested in Buying Property Abroad!

FAQ

What are some countries with no inheritance tax in 2024?

Why do some countries choose not to have an inheritance tax?

How does not having an inheritance tax impact the economy of a country?

What are the tax advantages for heirs in countries with no inheritance tax?

Are there any recent trends in inheritance tax policies?

Can you list some European countries with no inheritance tax?

What are the benefits of inheriting money in a tax-free country?

How does the absence of inheritance tax affect wealth distribution?

What are some Asian countries with no inheritance tax?

What are some legal considerations for moving assets to tax-free countries?

How can I avoid potential pitfalls when transferring assets internationally?

What are the economic impacts of inheritance tax-free policies in African nations?

Are there any countries in the Americas without inheritance tax?

What are the investment opportunities in tax-free inheritance countries?

What insights do financial advisors have about tax-exempt inheritance countries?

How do recent changes in inheritance tax affect global wealth distribution?

Source Links

- https://taxsummaries.pwc.com/quick-charts/inheritance-and-gift-tax-rates

- https://finance.yahoo.com/news/7-countries-where-no-death-120039485.html

- https://nomadcapitalist.com/finance/how-to-avoid-estate-taxes/

- https://taxfoundation.org/research/all/federal/estate-and-inheritance-taxes-around-world/

- https://en.wikipedia.org/wiki/Inheritance_tax

- https://taxfoundation.org/data/all/eu/estate-taxes-inheritance-taxes-gift-taxes-europe-2024/

- https://www.euronews.com/business/2024/04/16/inheritance-tax-across-europe-how-do-the-rules-rates-and-revenues-vary

- https://ifs.org.uk/publications/reforming-inheritance-tax

- https://nomoretax.eu/10-jurisdictions-with-no-inheritance-tax/

- https://www.telegraph.co.uk/money/tax/inheritance/countries-abolished-inheritance-tax-booming-death/

- https://www.gbnews.com/money/inheritance-tax-rates-iht-full-list

- https://www.globalcitizensolutions.com/a-guide-to-european-countries-with-no-wealth-tax/

- https://globalpayrollassociation.com/blogs/regional-focus/understanding-inheritance-and-estate-tax-in-asean

- https://www.aseanbriefing.com/news/understanding-inheritance-estate-tax-asean/

- https://koetz.digital/inheritance-tax-in-the-world-complete-chart/

- https://nomadcapitalist.com/finance/low-tax-countries-in-latin-america/

- https://www.jdkatz.com/a-comprehensive-guide-for-u-s-citizens-inheriting-assets-from-abroad/

- https://creativeplanning.com/international/insights/estate-planning/inheriting-from-united-states-while-living-abroad/

- https://files.taxfoundation.org/legacy/docs/TaxFoundation_FF458.pdf

- https://www.oecd.org/tax/tax-policy/inheritance-taxation-in-oecd-countries-brochure.pdf

- https://nomadcapitalist.com/finance/how-to-avoid-inheritance-tax/

- https://taxfoundation.org/data/all/eu/inheritance-taxes-estate-taxes-europe-2022/

- https://creativeplanning.com/international/insights/estate-planning/guide-to-international-estate-planning-for-cross-border-families/

- https://europa.eu/youreurope/citizens/family/inheritances/planning-inheritance/index_en.htm

- https://revenue.ky.gov/Documents/92F101714.pdf

- https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax-for-nonresidents-not-citizens-of-the-united-states

- https://taxation-customs.ec.europa.eu/paying-inheritance-tax-twice_en

Best Countries According to Aparthotel.com

- Best Countries To Live In Europe

- Best Countries To Move To From Canada

- Best Country To Live In

- Top Birth Tourism Countries

- Cheapest Asian Country To Live In

- Cleanest Country In The World

- Countries With No Capital Gains Tax

- Countries That Allow Dual Citizenship

- Countries With No Income Tax

- Countries With No Inheritance Tax

- Countries With No Property Tax

- Easiest Countries To Move To From USA

- Easiest EU Country To Get Citizenship

- Hardest Countries To Immigrate To

- Highest Tax Paying Country

- Instant Citizenship Countries

- Least Corrupt African Countries

- Lowest Tax Countries

- Non Extradition Countries

- Safest Countries In Africa

- Safest Countries In Europe

- Safest Country In Asia

- Safest Country In The World

- Safest Latin American Countries

- Second Passport Countries

- Territorial Tax Countries

- Which Country Pays Highest Salary

- Most LGBT Friendly Countries

- Best Countries For Expats

- Best Countries for Work-Life Balance

- The Best Countries For Hiking Adventures

- Best Countries for Expat Healthcare

- Safest Countries For Women Travelers

- The Best Country For Safari Adventures

- Top Solo Travel Destinations for Adventure Seekers

- The Best Solo Trips For Women

- Best Countries For Disabled Veterans

- Top Countries for Plastic Surgery

- Top Countries for All Inclusive Resort Vacations

- Top Countries With The Best Food Worldwide

- Best Countries For Black Expats

- Top Countries for Education

- Best Places To Retire In The World

- Top Countries for Transgender Expats to Live

- Best Places For Passport Bros

- Top 10 Best Countries For Surfing

- Top Countries for Digital Nomads

- Top European Countries for English Speakers to Live

- Top Countries for Software Engineers to Thrive

As a passionate, global-thinking Real Estate Investor I am constantly looking for the best opportunities to invest in Properties. With Aparthotel.com I am building an All-In-One Global Real Estate Platform, where people can analyse, rent or invest in properties. Additionally I help Investors with comparing the best financing options as well as give detailed Consultation on the buying process for Real Estate Investments around the world. I am looking forward to sharing my knowledge on this Website and feel free to reach out to me if you have any questions.

Comments